Trading 3x ETF securities is difficult. They can move against you quickly if you do not have a consistent methodology that works.

Trading 3x ETF securities is difficult. They can move against you quickly if you do not have a consistent methodology that works.

I spent 2008 and 2009 during major periods of volatility in the markets developing an entry and exit trading plan on bull and bear 3x ETF securities. When combined with my behavioral patterns, fibonacci sequencing, and a few other rules, we look to enter just prior to reversals.

There is a method on how to enter, and how to exit and we incorporate those principles to produce consistent profits.

Join for just $40 per month. Morning Guidance, Charts, Market projections and Alerts with Push Notifications, E-mail, and ongoing updates on each trade.

Click our Subscribe button to get registered. The service is only $40 per month which includes morning updates, charts, commentary and all trade advisories, alerts, and ongoing trade updates.

Memberful.com hosts the service on their website and billing is through Stripe with a Credit Card Secure payment.

“I recently joined this room and loving it by what I have seen so far. I realized playing 3x ETF solely on support and resistance does not give any edge. Really like the model of scaling into the positions”- @mmonis on stocktwits.com 11/8/19

Click to review our entire Track Record since Inception

SAMPLE 3X ETF ALERT SPXL 3/9/20

Up 13% in 24 hours as we went long the SP 500 at 3x leverage based on my projected March 9th market bottom call. We sold 1/2 for 8% gains on 3/10 and held 1/2 into the close up 13%.

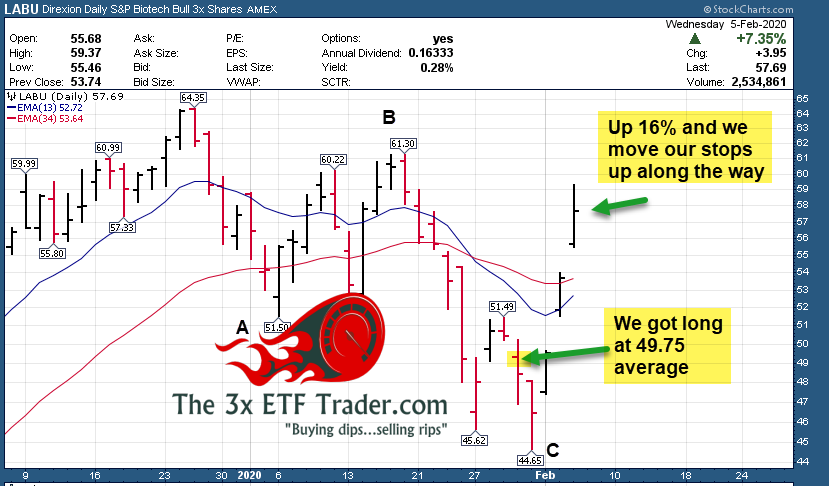

SAMPLE 3X ETF ALERT Feb 2020 on LABU

Up 16% in a few days after entry on 3x Bull Biotech ETF LABU- After ABC corrective pattern was nearing its final leg down (C Wave) we alerted to scale in long to LABU, days later it reversed hard to the upside.

SAMPLE 3X ETF Alert Oct 14 2019 TQQQ

Up 9.4% after two weeks as of 10/28/19

October 14th 2019 alert on Nasdaq 100 using TQQQ (Bull) looking for as much as 24% move-

“3x ETF Trade Alert- TQQQ (3x Bull Nasdaq 100) $63.70 currently Markets should be setting up for 4th quarter breakout. Tech should be a leader. The bullish triangle pattern on QQQ should be in the last phase of consolidation or maybe one more moderate pullback. Trade Parameters: Max entry 64.10 adding to 62 on dips Stop is 61 Near Close of market until updated Target is as high as $79 but that is likely a multi week target if we get the larger breakout If we are up 8% or more at anytime, sell 1/2 and hold 1/2 and we will move the stops up along the way”

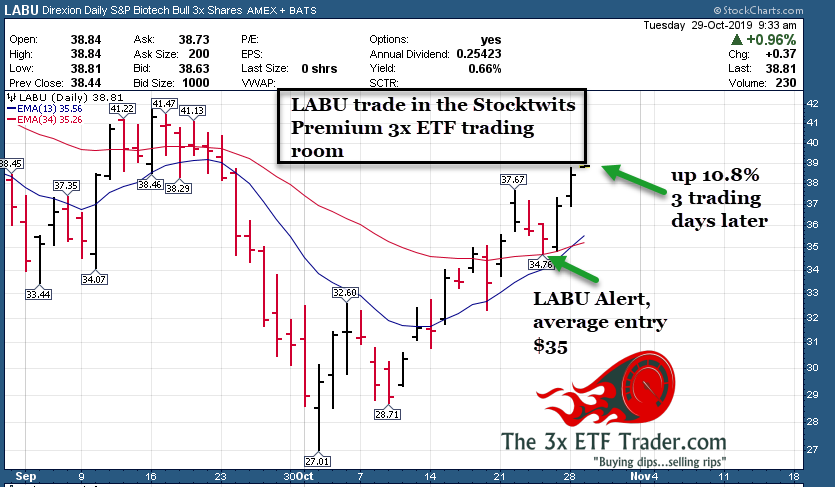

SAMPLE 3X ETF ALERT Oct 24 2019 LABU

Up 10.8% after 3 full trading days

October 24th 2019 alert on Biotech sector using LABU (3x Bull ETF)

” We were waiting for a “Wave 4″ if you will pullback off the recent rally in XBI ETF (LABU). Getting that now so I want to enter 1/2 position here in the range described below. If wave 4 pulls back a bit further, we will add another 1/2 on an alert I will send.”

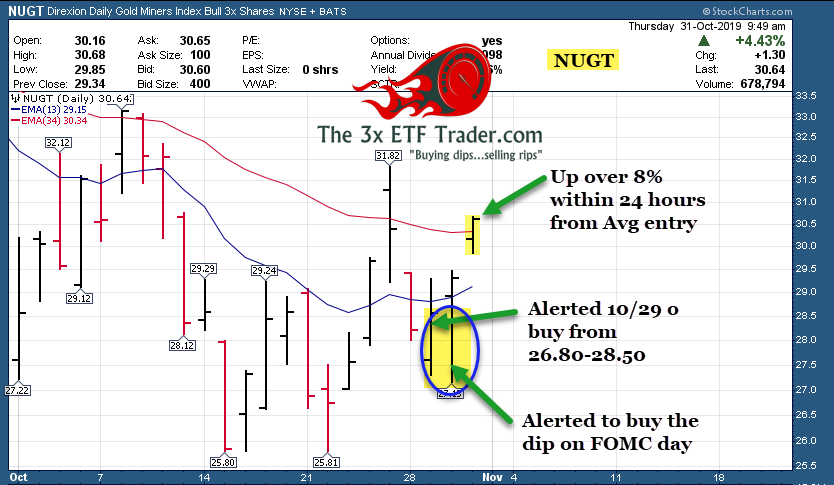

SAMPLE 3X ETF TRADE ALERT Oct 29 2019- NUGT

Up over 8% in 2 days

October 29th 2019 Alert on Gold Stock Sector using NUGT

“Per this mornings notes, we will take an initial 1/2 size position in NUGT here. Saw the GDX pullback today and hold so far, we have FOMC interest rate decision coming up, 93% chance of .25 bps rate cut. Gold pulled back after Friday’s surge, odds in favor for a bounce up.”

Trade Advice: Buy 1/2 size within 27.25-28.50 ranges Stop is 25.80 near closing for now Target is $33

How do I sign up or register for this service and how much is it?

Click our Subscribe button to get registered. The service is only $40 per month which includes morning updates, charts, commentary and all trade advisories, alerts, and ongoing trade updates.

Stocktwits.com hosts the service on their website and billing is through Stripe with a Credit Card Secure payment.

What are the profit objectives on each trade and how do you handle stops etc?

I look for 8-20% gains on each reversal set up for the 3x ETF trade. We typically buy 1/2 position over 1-2 days, then depending on action add another 1/2 to a full position. My reversal set ups and the way we enter and exit are based on years of analysis and methodology I developed for behavioral patterns at sentiment and Elliott Wave extremes. We provide stop loss advice and update is as the trade moves along. We also sell 1/2 position at 8% gains and hold 1/2 and raise the stop as our standard rule.

How many trades per week can we expect?

Typically we will have 1-3 trades on average per week, but it will depend on market conditions based on my Elliott Wave analysis and proprietary forecast models. We will be patient for the best set ups with risk-reward in our favor.

How many open positions will you have?

Anywhere from 1-3 open positions at a time will be typical. If we do not see a set up we will have no positions and just be patient. The goal is to make profits and not to over trade just for the sake of trading.

What 3x ETF securities will you be trading or advising on?

These will vary but will likely be focused on Small Caps, Technology, SP 500 Index, Gold related, and Biotech.

Symbols such as SPXL/SPXU, TNA/TZA, NUGT/DUST, LABU/LABD, TQQQ/SQQQ Etc. These are all symbols I have many years of experience trading and advising on in my other subscription services and they work well off behavioral models.

How do I receive notifications?

E-mail notification and online post for every morning update, weekend report, trade alert and all published updates

More Questions?

Any other questions should be directed to reversaltraders@gmail.com and Dave will personally answer