The 3x ETF Trader – Bull and Bear

3x ETF Swing Trading

A Subscription Service of The Market Analysts Group, LLC

A Subscription Service of The Market Analysts Group, LLC

Former Stocktwits 3x ETF Premium Room 2018-2024

Now on Memberful platform

From 2019 to 2024, The 3x ETF Trader was hosted on Stocktwits.com as a Premium Room. Since their pivot away from Premium Rooms, we’ve brought our same proven service to Memberful. Nothing else has changed – except more control and flexibility.

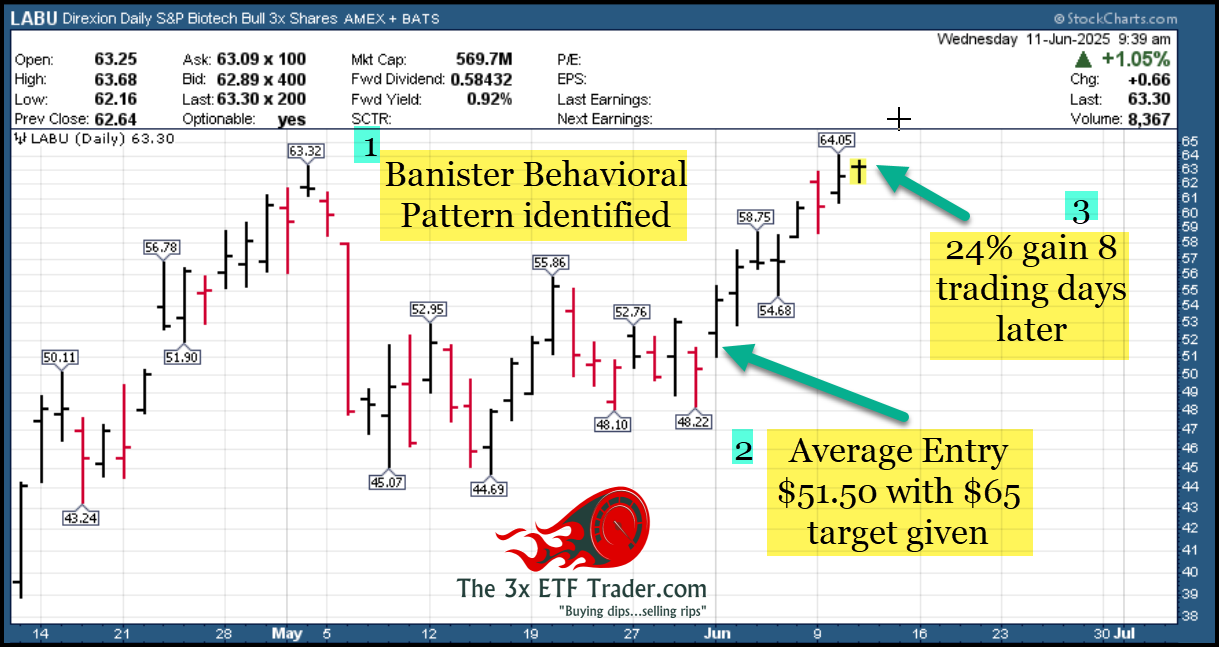

Using Human Behavioral Patterns with a 70% Success Rate Since 2019

Who This Service Is For:

✔ Traders looking for clear, confident entries and exits

✔ Those who swing 2–4 ETF positions at a time

✔ Traders tired of “guru noise” and chatroom chaos and want an edge

✔ Anyone who respects timing, sentiment, and price behavior

$40/month or $395 per year. Cancel Anytime. 30 day money back guarantee

📊 Why Traders Love Us

✅ 70%+ profitable trades from 2019–2025

✅ Real-time Alerts via SMS, Email, and Online Posts

✅ Morning Daily Market Reports, Trade Setups, and Sector Analysis, Plus Charts

✅ Access to our behavioral pattern trading methodology

💥 +59% Since March – The Power of Following the Plan 💥

“Dave, a sincere THANK YOU for everything! I just looked at my numbers and I’m up 59% since subscribing to the ETF service in late March.

🚨 To anyone reading this: I cannot stress enough the importance of scaling in over time and following Dave’s advice to the penny.

I loosely followed it at first — which hurt me — but once I stayed disciplined, my profits took off.

It’s hard to fight the greed bug… but sticking to the plan has more than paid off.

Dave, keep up the great work. I look forward to learning more from your experience and research.

— @Hank_Hill15

✅ Learn the System. Follow the Maps. Scale Your Gains.

👉 Click here to join now and experience the power of behavioral-based ETF swing trading. 30 day money back guarantee, just $40 to start!

🎥 Video: Overview of Our Swing Trading Services

About Dave Banister

- Founder and Chief Strategist behind Banister Behavioral Patterns

- 65,000+ Stocktwits followers and over 16 years of subscription service history

- Expert in Elliott Wave Theory and behavioral market analysis trading and forecasting

- Track record of consistent profitable trade alerts in ETFs and SP500 Futures, and Stocks

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of.” – Peter Brandt, CEO, Factor LLC (8/30/17)

🚀 Track Record & FAQ – View Before You Subscribe

We don’t just talk – we show results. Dive into real alerts, charts, and historical trades.

Market indexes and sectors move based on behavioral and emotional investor patterns. Our method applies these principles to 3x ETF trading — producing consistent, short-term trade success.

Recent 24% gain in 2025 on LABU 3x Bull Biotech in 8 Trading Days